Cyber Risk Management

Strategies for Success in Today’s Stock Markets

In the world of finance, the stock market has long been a symbol of opportunity and risk, attracting a diverse array of investors seeking to grow their wealth. However, the landscape of today’s stock markets is marked by increasing complexity and rapid change. From the rise of digital trading platforms to the influence of global economic events and the ever-evolving nature of industries, it’s clear that success in the stock market demands more than just luck.

Reliable investments sources

To maximize successful investments, traders must stay well-informed. It can be achieved by utilizing reliable sources such as:

- financial news websites;

- market research reports;

- experts who share market strategies;

- specialized educational resources like YouHold.

These sources provide valuable information regarding the global economy, events, politics, and investor expectations that are essential for making informed trading decisions.

Another important stock trading strategy is to analyze stock market trends. It involves studying historical price data, identifying patterns and trends, and using technical analysis tools to predict future price movements. By understanding the patterns and trends of the market, traders can make more informed decisions about when to buy or sell stocks.

Additionally, diversification is a crucial strategy for success in today’s Stock Exchanges. Investors should not put all their eggs in one basket but instead spread their investments across different sectors and industries. It helps to mitigate risk and maximize potential returns.

Furthermore, having a well-defined investment strategy is essential. Investors should evaluate the market, set clear goals, determine risk tolerance, and establish a plan for buying and selling stocks. A well-thought-out investment strategy helps traders stay focused and disciplined and achieve long-term success by avoiding impulsive decisions based on short-term market fluctuations.

Moreover, it is crucial for traders to assess and adjust their investment portfolios regularly. It means reviewing the performance of stocks regularly and making necessary adjustments to optimize returns. By staying informed, analyzing trends, diversifying investments, having a well-defined strategy, and assessing their portfolio, traders can increase their chances of choosing the right stocks.

In conclusion, succeeding in today’s stock markets requires a combination of careful planning, disciplined execution, and a commitment to ongoing learning. By learning diverse strategies, investors can navigate the complexities of the stock market with greater confidence and increase their chances of achieving their financial goals. Whether you’re a novice or an experienced investor, remember that the stock market is a dynamic arena, and adapting your strategy to changing conditions is key to long-term success.

-

Manage Your Business2 days ago

Manage Your Business2 days agoTOP 10 VoIP providers for Small Business in 2024

-

Cyber Risk Management6 days ago

Cyber Risk Management6 days agoHow Much Does a Hosting Server Cost Per User for an App?

-

Outsourcing Development6 days ago

Outsourcing Development6 days agoAll you need to know about Offshore Staff Augmentation

-

Software Development6 days ago

Software Development6 days agoThings to consider before starting a Retail Software Development

-

Edtech2 days ago

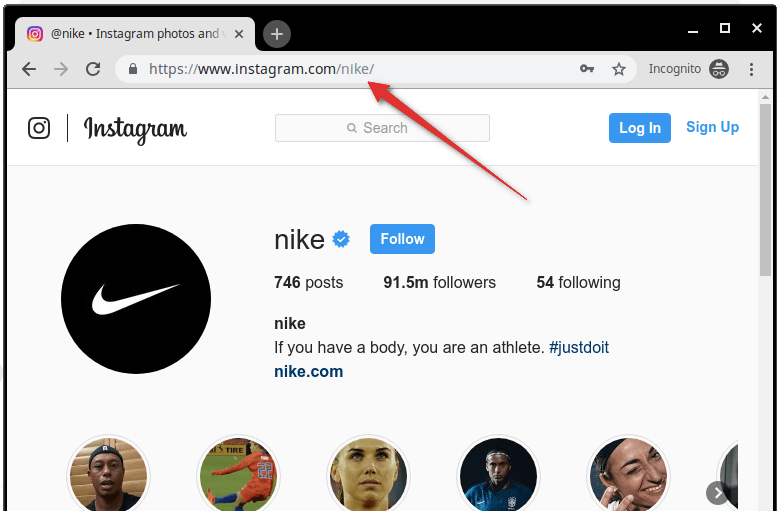

How to fix PII_EMAIL_788859F71F6238F53EA2 Error

-

Grow Your Business5 days ago

Grow Your Business5 days agoThe Average Size of Home Office: A Perfect Workspace

-

Solution Review5 days ago

Top 10 Best Fake ID Websites [OnlyFake?]

-

Business Imprint6 days ago

How Gaming Technologies are Transforming the Entertainment Industry