Grow Your Business

Florida’s Tax Benefits for Self-Employed People

In Florida, there are many advantages to working for yourself, such as the freedom to choose your own hours, clients, and location of business. Nevertheless, optimizing tax savings and accurately filing taxes can present a challenge for independent contractors. Thankfully, there are a number of tax benefits Florida offers self-employed people that can allay some of these worries. We’ll look at these 1099 tax benefits in this post and talk about how independent contractors can take full advantage of them.

| Tax Tool/Strategy | Purpose | Benefit to Self-Employed |

|---|---|---|

| LLC Tax Calculator | Estimate tax liability for LLCs | Simplifies tax calculations |

| Medicare Tax Calculator | Compute Medicare tax based on income | Ensures accurate Medicare tax payments |

| Tax Estimate Calculator | Estimate total annual tax liability | Helps plan finances and save for tax season |

| Business Expense Deductions | Reduce taxable income by deducting expenses | Lowers overall tax burden |

| Home Office Deduction | Deduct home office expenses | Reduces taxable income further |

| SEP IRA Contributions | Contribute to a retirement account | Lowers taxable income, tax-deferred growth |

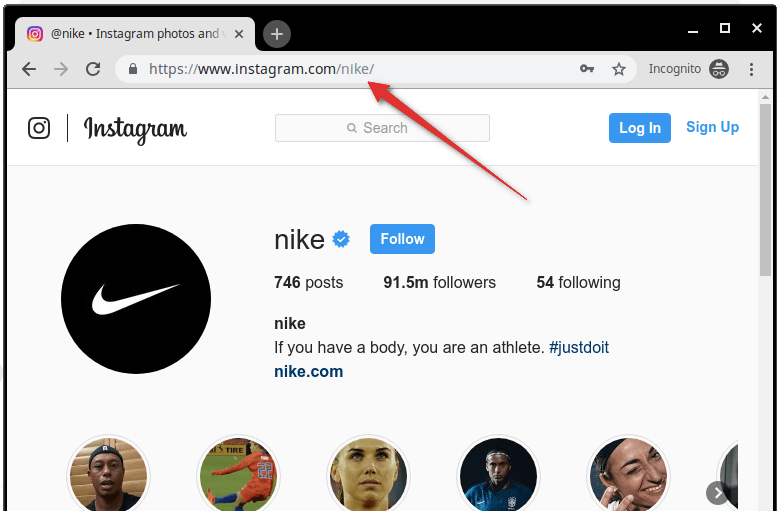

Creating a formal business structure is one of the first things self-employed people in Florida need to do. Because of its ease of use and versatility, a Limited Liability Company (LLC) is a popular choice among independent contractors. While enabling the business owner to report business revenue and expenses on their personal tax return, an LLC shields them from personal liability. This makes filing taxes easier and does away with the requirement for a separate corporate tax return.

Freelancers can make use of an LLC tax calculator to ascertain the tax benefits of an LLC. Using the income and expenses of the business as a basis, this tool assists in estimating the tax liability. Freelancers can obtain a clear picture of their tax obligations and make appropriate plans by entering the necessary data. The self-employment taxes, which consist of Social Security and Medicare taxes, are taken into consideration by the LLC tax calculator. Since they pay both the employer and employee portions of these taxes, self-employed people may find them to be substantial.

Key Considerations for Florida’s Self-Employed:

- Create a Suitable Business Structure: Consider an LLC for flexibility and tax benefits.

- Utilize Tax Calculators: Use LLC, Medicare, and tax estimate calculators for accurate tax planning.

- Document Business Expenses: Keep detailed records of all deductible expenses.

- Explore Deductions: Maximize deductions, including the home office deduction.

- Invest in Retirement: Contribute to a SEP IRA for long-term savings and immediate tax benefits.

- Stay Informed: Regularly update knowledge on tax laws and consult with tax professionals.

One more thing to think about is the Medicare tax. In the state of Florida, self-employed workers must pay the Medicare tax, which is 2.9% of their net self-employment income. For high-income earners, there is an additional Medicare tax of 0.9%. Individuals with incomes over $200,000 for single filers or $250,000 for married couples filing jointly are subject to this additional tax. Freelancers can utilize a Medicare tax calculator to precisely compute their Medicare tax. This tool assists in calculating the accurate amount due based on the user’s filing status and income.

Freelancers can benefit from using a tax estimate calculator in addition to the Medicare and LLC tax calculators. This tool assists in estimating the total tax liability for the year while accounting for different credits and deductions. Freelancers can get a ballpark estimate of their IRS tax obligation by entering their income, expenses, and other pertinent data. This can be especially helpful when creating a budget and making sure you have enough money saved up for taxes.

The Florida tax benefits for self-employed individuals include a substantial deduction for business expenses. A wide range of business-related expenses, such as office supplies, equipment, travel expenses, and marketing costs, are deductible for freelancers. Freelancers can minimize their taxable income and maximize their deductions by maintaining thorough records and receipts. To make sure that all legitimate costs are claimed, it is crucial to speak with a tax expert or utilize tax software.

The home office deduction is another tax benefit that self-employed people in Florida can take advantage of. Freelancers may be able to write off some costs associated with the space they occupy in their home if it is used solely for business. This can cover a portion of the cost of utilities, house maintenance, and rent or mortgage interest. Nevertheless, in order to be eligible for this deduction, you must fulfill certain IRS requirements. A tax expert’s advice can help guarantee compliance and optimize tax savings.

Retirement Planning: Tax Benefits of SEP IRAs

In Florida, self-employed people can also make contributions to retirement plans with tax benefits. The Simplified Employee Pension (SEP) IRA is one well-liked choice. Freelancers can contribute a maximum of $58,000 (2021 limit) or up to 25% of their net self-employment income to a SEP IRA. A freelancer’s taxable income is decreased by contributions to a SEP IRA, which are tax deductible. The account’s earnings also increase tax-deferred until retirement, making it an excellent long-term savings plan.

Bottom Line

In conclusion, Florida offers a number of tax benefits to independent contractors. Freelancers can precisely estimate their tax liability and make plans by using tools like the LLC tax calculator, Medicare tax calculator, and tax estimate calculator. Other ways to optimize tax savings include deducting business expenses, utilizing the home office deduction, and making contributions to retirement plans. To ensure compliance and maximize these tax benefits, freelancers must stay up to date on the most recent tax laws and seek advice from a tax expert. Florida self-employed people can reduce their tax liability and concentrate on expanding their businesses by doing this.

-

Manage Your Business2 days ago

Manage Your Business2 days agoTOP 10 VoIP providers for Small Business in 2024

-

Cyber Risk Management6 days ago

Cyber Risk Management6 days agoHow Much Does a Hosting Server Cost Per User for an App?

-

Outsourcing Development6 days ago

Outsourcing Development6 days agoAll you need to know about Offshore Staff Augmentation

-

Software Development6 days ago

Software Development6 days agoThings to consider before starting a Retail Software Development

-

Edtech2 days ago

How to fix PII_EMAIL_788859F71F6238F53EA2 Error

-

Grow Your Business5 days ago

Grow Your Business5 days agoThe Average Size of Home Office: A Perfect Workspace

-

Solution Review5 days ago

Top 10 Best Fake ID Websites [OnlyFake?]

-

Business Imprint6 days ago

How Gaming Technologies are Transforming the Entertainment Industry