Grow Your Business

Ensuring Employer of Record Compliance: A CEO and CTO Guide

Overview of employer of record compliance

In today’s complex and ever-evolving business landscape, employer of record compliance

Overview of employer of record compliance

In today’s complex and ever-evolving business landscape, employer of record compliance has become a critical concern for CEOs and CTOs alike. Compliance with employment laws and regulations is not just a legal obligation but also an essential aspect of maintaining a reputable and successful business.

When it comes to understanding employer of record compliance, it is important to first grasp the concept of an employer of record (EOR). An EOR is a specialized service provider that takes on the legal and administrative responsibilities of employing workers on behalf of a company. This arrangement allows businesses to expand their operations globally without the need to establish legal entities in every country.

EOR compliance refers to the adherence to all relevant laws, regulations, and best practices associated with the employment of workers through an EOR. It ensures that companies meet their obligations in terms of employment contracts, tax and payroll compliance, data protection and privacy, and immigration regulations.

In this comprehensive guide, we will delve into the intricacies of employer of record compliance, exploring the risks of non-compliance, key considerations for staying compliant, and the steps companies can take to ensure they meet all necessary requirements. We will also discuss the benefits that come with maintaining EOR compliance, including risk mitigation, a solid reputation, and smooth operational processes.

So, whether you are a CEO seeking to expand your business internationally or a CTO responsible for managing global workforce operations, this guide will equip you with the knowledge and strategies needed to navigate the complex world of employer of record compliance with confidence and success.

Stay tuned as we embark on this enlightening journey through the realm of employer of record compliance and discover how it can benefit your organization in more ways than you can imagine. Don’t miss out on the valuable insights and practical solutions that await you in the following sections. Let’s begin!

Understanding Employer of Record (EOR)

As a CEO or CTO, it’s imperative to have a deep understanding of the concept of Employer of Record (EOR) and its significance in ensuring compliance within your organization. By comprehending the intricacies of EOR, you can effectively navigate the complex landscape of employment laws and regulations, mitigating potential risks and safeguarding your company’s reputation.

Definition of EOR

So, what exactly does the term “Employer of Record” mean? In simple terms, an Employer of Record is a third-party entity that takes on the responsibility of being the legal employer for your workforce. This means that the EOR handles crucial HR functions, such as payroll, tax compliance, benefits administration, and employee onboarding, while you maintain direct control over the day-to-day operations and management of your employees.

Importance of EOR Compliance

In this era of ever-evolving employment laws and regulations, maintaining EOR compliance is of utmost importance. Failing to adhere to the legal requirements can lead to severe consequences, ranging from financial penalties to reputational damage. By ensuring EOR compliance, you not only protect your organization from potential legal and financial risks but also demonstrate your commitment to ethical and responsible business practices.

Employing an EOR is a strategic decision that allows you to focus on your core business operations while entrusting the complexities of employment-related compliance to experts in the field. The EOR assumes the responsibility of staying up-to-date with the latest employment laws, tax regulations, and data protection requirements, ensuring that your organization remains in full compliance at all times.

By partnering with a reliable EOR provider, you gain access to their expertise and knowledge, enabling you to navigate the intricate web of employment regulations effortlessly. This collaboration empowers you to make informed decisions and implement best practices, safeguarding your company’s interests and minimizing potential legal vulnerabilities.

Moreover, EOR compliance goes beyond legal obligations. It also plays a crucial role in fostering a positive work environment and maintaining employee trust. When your employees are confident that their rights are protected, their salaries are accurately calculated, and their benefits are administered smoothly, they can focus on their roles and responsibilities, driving productivity and overall organizational success.

In the next section, we will delve deeper into the various compliance risks and consequences associated with EOR non-compliance, shedding light on the potential pitfalls that await those who overlook the importance of maintaining EOR compliance.

Click here to learn more about the benefits of employer of record compliance.

Compliance Risks and Consequences

When it comes to employer of record compliance, there are several risks and consequences that businesses need to be aware of. Failing to adhere to the legal and regulatory requirements can have serious implications for both the company and its employees. In this section, we will explore the legal and financial risks, as well as the reputational risks and consequences of non-compliance.

Legal and Financial Risks

Ensuring employer of record compliance is crucial for avoiding legal and financial pitfalls. Non-compliance with employment laws and regulations can result in hefty fines, penalties, and even lawsuits. These risks can arise from various areas, such as misclassification of employees, failure to provide proper benefits, or inadequate record-keeping practices.

Misclassification of employees is one common legal risk. If an employee is misclassified as an independent contractor, for instance, the company may be held liable for unpaid taxes, overtime wages, and benefits. This can lead to substantial financial burdens and damage the company’s bottom line.

Failure to provide proper benefits is another legal risk that can have significant consequences. Depending on the jurisdiction, employers may be required to offer certain benefits such as health insurance, retirement plans, and paid time off. Failing to provide these benefits can result in legal action and damage the company’s reputation.

Inadequate record-keeping practices can also expose businesses to legal and financial risks. Accurate and up-to-date records are essential for demonstrating compliance with employment laws and regulations. Failure to maintain these records can lead to penalties and make it difficult to defend against potential legal claims.

Reputational Risks

Maintaining a good reputation is vital for any business. Non-compliance with employer of record regulations can tarnish a company’s image and erode trust among stakeholders, including clients, employees, and investors. In today’s interconnected world, news of non-compliance spreads quickly, potentially damaging the company’s brand and future prospects.

Negative publicity resulting from non-compliance can have far-reaching consequences. It can lead to a loss of customers and clients who may prefer to work with companies that prioritize compliance and ethical practices. Additionally, prospective employees may be deterred from joining an organization with a tarnished reputation, impacting the company’s ability to attract and retain top talent.

Consequences of Non-Compliance

The consequences of non-compliance with employer of record regulations can be severe and far-reaching. Beyond the legal, financial, and reputational risks we’ve discussed, businesses may face additional penalties and sanctions imposed by regulatory authorities. These can include increased scrutiny, audits, and even suspension of operations.

Moreover, non-compliance can disrupt business operations, leading to inefficiencies and decreased productivity. Resolving compliance issues often requires significant time and resources, diverting attention from core business activities. Additionally, the stress and uncertainty caused by non-compliance can negatively impact employee morale and overall workplace culture.

To mitigate these risks and consequences, businesses must prioritize employer of record compliance. In the following section, we will explore key considerations and steps that can be taken to ensure compliance and reap the benefits of doing so.

Continue reading: Employer of Record Benefits

Key Compliance Considerations

When it comes to ensuring employer of record compliance, there are several key considerations that both CEOs and CTOs should keep in mind. From adhering to employment laws and regulations to maintaining tax and payroll compliance, these considerations are vital in mitigating risks and maintaining a smooth operation. In this section, we will delve into the four main compliance areas that require careful attention: employment laws and regulations, tax and payroll compliance, data protection and privacy, and immigration compliance.

Employment Laws and Regulations

Employment laws and regulations vary from country to country, and sometimes even within different regions of the same country. It is crucial for companies to stay informed and up-to-date on these laws to ensure compliance. Failure to do so can result in legal and financial risks, damaging the company’s reputation and potentially leading to severe consequences.

To navigate the complex landscape of employment laws and regulations, it is advisable to seek legal counsel or partner with an employer of record (EOR) provider who has expertise in this area. They can help interpret and apply the laws correctly, ensuring that your company remains compliant while operating in various jurisdictions.

Tax and Payroll Compliance

Tax and payroll compliance is another critical consideration for employers. Different countries have different tax systems and requirements, making it essential to understand and comply with the tax regulations in each location where your company operates.

Non-compliance with tax and payroll regulations can lead to significant financial penalties and legal consequences. To avoid these risks, it is crucial to have a thorough understanding of tax laws and regulations or partner with an EOR provider that specializes in managing tax and payroll obligations. They can handle the complexities of tax calculations, deductions, and filings, ensuring accuracy and compliance.

Data Protection and Privacy

In today’s digital age, data protection and privacy have become increasingly important compliance considerations. Companies must safeguard sensitive employee data and ensure compliance with data protection laws, such as the General Data Protection Regulation (GDPR) in the European Union.

To protect employee data, it is crucial to implement robust data security measures, including encryption, access controls, and regular audits. Additionally, companies should establish clear policies and procedures regarding data handling, consent, and breach notifications. Regular employee training and awareness programs can also help foster a culture of data protection and privacy compliance within the organization.

Immigration Compliance

For companies operating internationally or employing foreign workers, immigration compliance is a key consideration. Each country has its own immigration laws and regulations, which must be followed to legally hire and retain foreign talent.

To ensure immigration compliance, it is vital to understand the specific requirements and processes for sponsoring work visas or permits. Working with an EOR provider can be beneficial in navigating the complexities of immigration compliance, as they have expertise in managing global workforce mobility and can guide you through the necessary steps to remain compliant.

By addressing these key compliance considerations, companies can mitigate risks, avoid penalties, and maintain a good reputation. Compliance with employment laws and regulations, tax and payroll requirements, data protection and privacy laws, and immigration regulations is vital for any organization operating globally. Partnering with a reliable EOR provider can provide the expertise and support needed to navigate these compliance challenges effectively.

Employer of record services can assist companies in achieving compliance in these key areas, ensuring a smooth and legally sound operation. In the next section, we will explore the steps that CEOs and CTOs can take to ensure employer of record compliance.

Steps to Ensure Employer of Record Compliance

In the ever-evolving landscape of employment regulations, it is crucial for businesses to prioritize employer of record compliance. To maintain a strong and reputable standing, CEOs and CTOs must take proactive measures to navigate the intricate web of legal obligations. By following a well-defined set of steps, these leaders can ensure that their organizations remain compliant and avoid potential pitfalls.

Conduct Regular Compliance Audits

One of the most effective ways to stay on top of employer of record compliance is through regular compliance audits. These audits involve a comprehensive review of existing processes, policies, and documentation to identify any potential areas of non-compliance. By assessing the organization’s adherence to employment laws, tax regulations, data protection protocols, and immigration requirements, businesses can proactively address any shortcomings and implement corrective measures.

Stay Updated on Employment Laws

Employment laws and regulations are subject to frequent changes and updates. To keep abreast of these developments, it is crucial for CEOs and CTOs to stay informed about the latest legal requirements. By dedicating time and resources to monitor legislative changes, organizations can ensure that their practices align with the most current standards. This can be achieved through regular consultation of legal experts, participation in industry forums, and subscription to relevant publications.

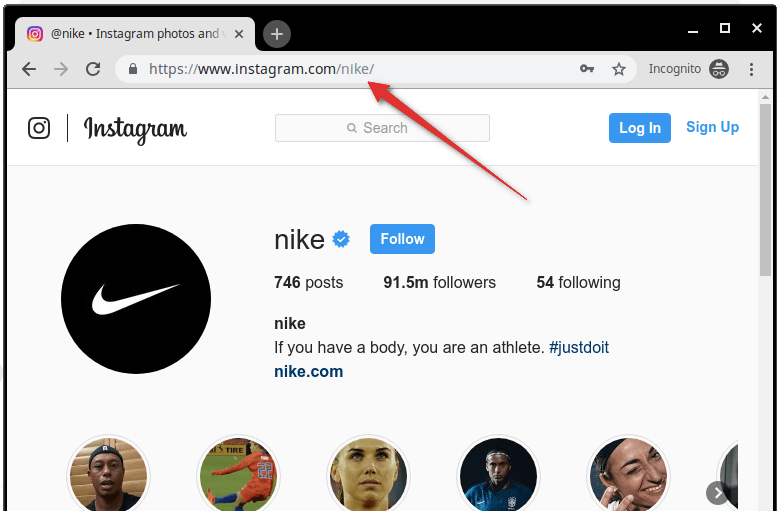

Partner with a Reliable EOR Provider

Navigating the complex landscape of employer of record compliance can be a daunting task. To alleviate this burden, organizations can opt to partner with a reliable employer of record (EOR) provider. These specialized entities possess the expertise and resources to handle various compliance-related responsibilities, such as tax and payroll compliance, data protection, and immigration requirements. By leveraging the services of an EOR provider, businesses can effectively mitigate risks and ensure adherence to all relevant regulations.

Employee Training and Education

A well-informed workforce is essential for maintaining employer of record compliance. It is imperative for organizations to prioritize employee training and education on legal obligations, data protection practices, and other compliance-related matters. By equipping employees with the necessary knowledge and tools, businesses can foster a culture of compliance and empower individuals to make informed decisions. Regular training sessions, workshops, and educational resources can contribute to a more compliant and responsible work environment.

Establish Compliance Monitoring Systems

To maintain a robust employer of record compliance framework, organizations should establish compliance monitoring systems. These systems allow for ongoing assessment and measurement of compliance efforts. By implementing regular checks, audits, and reporting mechanisms, businesses can identify and address any compliance gaps in a timely manner. This proactive approach ensures that compliance remains a priority and enables organizations to make informed decisions based on accurate compliance data.

By following these steps, CEOs and CTOs can safeguard their organizations against potential compliance risks and consequences. Prioritizing employer of record compliance not only mitigates legal and financial risks but also protects the organization’s reputation. Embracing a culture of compliance and investing in reliable partners and resources will enable businesses to navigate the intricate landscape of employment regulations with confidence and ensure smooth operations.

To learn more about the benefits of employer of record compliance, check out our comprehensive guide here.

Benefits of Employer of Record Compliance

Ensuring employer of record compliance goes beyond mere adherence to rules and regulations. It brings a multitude of benefits that can significantly impact a company’s success and reputation. By prioritizing compliance, organizations can mitigate risks and penalties, maintain a good reputation, and ensure smooth operations. Let’s delve into each of these benefits in more detail.

Mitigate Risks and Penalties

Compliance with employer of record obligations helps mitigate risks and penalties that may arise from non-compliance. It is essential to understand that failing to comply with employment laws, tax regulations, data protection, or immigration requirements can result in severe consequences. These consequences may include hefty fines, legal disputes, and even the suspension of business operations. By carefully adhering to all relevant compliance standards, companies can avoid these risks and protect their financial stability.

Maintain Good Reputation

Maintaining a good reputation is paramount for any organization’s long-term success. Non-compliance with employer of record obligations can tarnish a company’s image and erode the trust of both employees and clients. Word travels fast, especially in today’s interconnected world, and negative publicity can have far-reaching implications. On the other hand, demonstrating a commitment to compliance portrays a responsible and trustworthy business. By upholding ethical standards and ensuring compliance, companies can safeguard their reputation and attract top talent and clients.

Ensure Smooth Operations

Compliance with employer of record requirements ensures smooth operations within an organization. By staying up-to-date with employment laws, tax and payroll regulations, data protection measures, and immigration policies, companies can avoid disruptions and complications. Compliance promotes a harmonious working environment, where employees feel protected and confident in their rights. Additionally, it allows for better planning and decision-making, as organizations can navigate legal and regulatory landscapes with ease. The result is improved efficiency, reduced operational risks, and a focus on core business objectives.

In conclusion, the benefits of employer of record compliance are manifold and extend beyond mere legal obligations. By prioritizing compliance, organizations can mitigate risks and penalties, maintain a good reputation, and ensure smooth operations. Embracing compliance not only protects a company’s financial stability and image but also fosters a positive work culture and paves the way for sustainable growth. So, let’s make compliance a cornerstone of our business practices and reap the rewards it brings.

To learn more about the benefits of employer of record compliance, you can visit this link.

Conclusion

In conclusion, ensuring employer of record compliance is of paramount importance for companies seeking to navigate the complex landscape of employment laws and regulations. By understanding the definition and significance of an employer of record (EOR), businesses can safeguard themselves against legal, financial, and reputational risks.

Compliance with employment laws and regulations is a multifaceted endeavor that requires careful attention to detail. From tax and payroll compliance to data protection and privacy, companies must diligently adhere to the various requirements imposed by governing bodies. Failure to do so can result in severe consequences, including hefty fines, legal disputes, and damage to the company’s reputation.

To mitigate these risks, it is essential to take proactive steps towards ensuring employer of record compliance. Regular compliance audits can help identify any potential gaps or areas of improvement, allowing businesses to rectify issues before they escalate. Staying updated on employment laws and regulations is also crucial, as the legal landscape is constantly evolving.

Partnering with a reliable EOR provider can alleviate the burden of compliance, as these professionals specialize in navigating the intricacies of employment regulations. Their expertise and resources can contribute significantly to maintaining compliance and minimizing risk. Additionally, providing employees with the necessary training and education on compliance matters can foster a culture of awareness and accountability within the organization.

Establishing compliance monitoring systems is another crucial aspect of ensuring employer of record compliance. By implementing robust processes and technologies, businesses can monitor their compliance efforts in real-time and address any non-compliance issues promptly. This proactive approach can help prevent costly mistakes and ensure smooth operations.

The benefits of employer of record compliance are far-reaching. By mitigating risks and penalties, companies can protect their financial stability and reputation. Compliance also fosters trust among employees, clients, and stakeholders, further enhancing the company’s image and credibility. Moreover, adhering to employment laws and regulations promotes fair and ethical practices, creating a positive work environment for all.

In a rapidly changing business landscape, where compliance requirements continue to evolve, companies must prioritize employer of record compliance. By embracing this responsibility and dedicating resources to compliance efforts, organizations can navigate the complexities of the legal framework while focusing on their core business objectives.

To learn more about the benefits of an employer of record and how it can support your business, visit employer of record benefits.

-

Manage Your Business24 hours ago

Manage Your Business24 hours agoTOP 10 VoIP providers for Small Business in 2024

-

Cyber Risk Management5 days ago

Cyber Risk Management5 days agoHow Much Does a Hosting Server Cost Per User for an App?

-

Outsourcing Development5 days ago

Outsourcing Development5 days agoAll you need to know about Offshore Staff Augmentation

-

Software Development5 days ago

Software Development5 days agoThings to consider before starting a Retail Software Development

-

Edtech24 hours ago

How to fix PII_EMAIL_788859F71F6238F53EA2 Error

-

Grow Your Business5 days ago

Grow Your Business5 days agoThe Average Size of Home Office: A Perfect Workspace

-

Solution Review5 days ago

Top 10 Best Fake ID Websites [OnlyFake?]

-

Business Imprint5 days ago

How Gaming Technologies are Transforming the Entertainment Industry