Cyber Risk Management

Best Crypto DCA Bots For Investors & Traders

Prioritizing profit maximization and risk management is essential for every trader. By utilizing a DCA crypto bot to trade digital assets, you can mitigate certain risks and construct a robust portfolio. Let’s delve into the mechanics of Dollar-Cost-Averaging (DCA), discuss how to choose the ideal automation vendor for your investment pursuits, and explore the available DCA bots.

DCA Cryto Meaning

DCA stands for dollar cost averaging and is a concept that was originally introduced by the esteemed economist Benjamin Graham in 1949. Graham’s groundbreaking idea was that acquiring assets in small amounts over defined intervals is the most effective way to build wealth, at least from a statistical standpoint.

While this tactic has been employed by numerous investors over the years, it saw a dramatic surge in popularity among the broader retail trading community with the advent of cryptocurrencies. The DCA buying approach is a favorite amongst bitcoin advocates who buy bite-sized pieces of bitcoin with each paycheck.

While this approach often lowers the average investment cost in the stock market, critics have argued it’s not as beneficial when it comes to unpredictable crypto markets. See, cryptocurrencies, being relatively new, haven’t generated enough data for comprehensive analysis. In the past decade, bitcoin has experienced explosive growth, gaining thousands of percentile points in value, and has also witnessed dramatic drops of more than half its value within mere months. Despite these caveats, DCA has so far proven to be an effective strategy for cryptocurrencies. In fact, for some, it has become a reliable method to steadily accumulate profits or build a robust portfolio over time.

How to DCA Cryto?

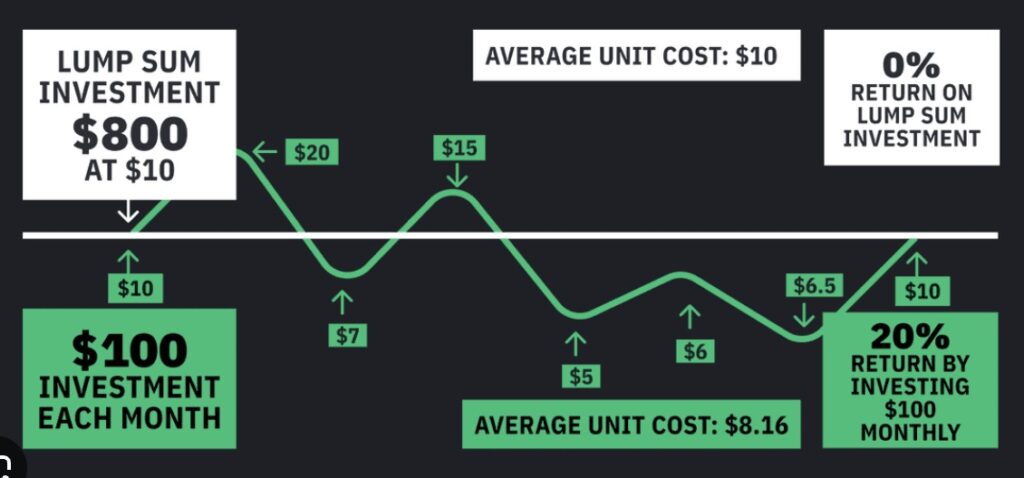

Imagine you’re planning to buy Bitcoin valued at $30,000. Rather than plunging in with a single purchase, you opt for a more strategic approach: you decide to buy $1000 worth of Bitcoin every day at precisely 9 am in the morning for the next 30 consecutive days. Regardless of Bitcoin’s fluctuating price, you stick to this routine, buying at your set time daily. The main objective here is long-term accumulation with a disciplined approach.

What Is a DCA Bot?

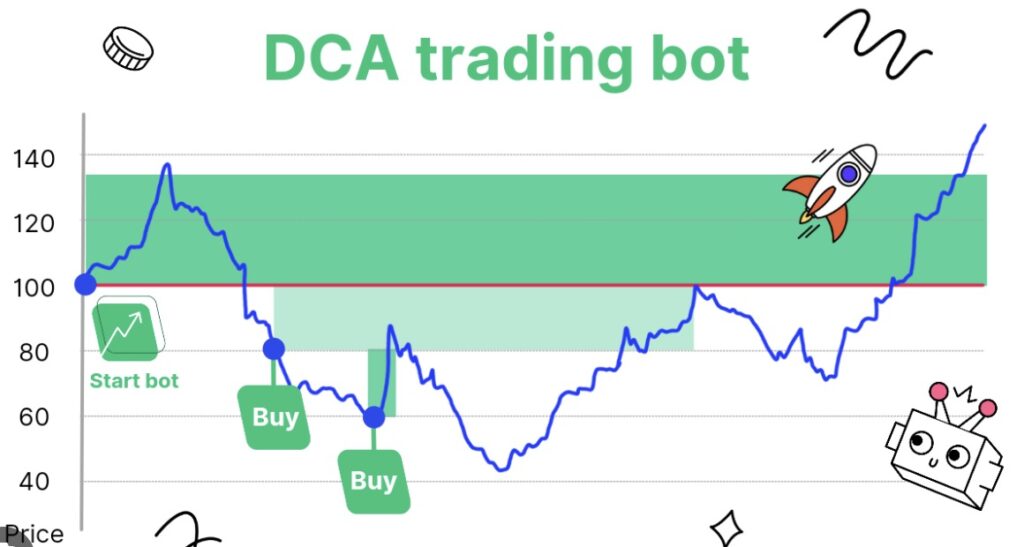

DCA crypto bots are sophisticated software solutions designed to automate the application of the dollar cost averaging strategy in cryptocurrency.

The DCA method involves consistently investing a specific amount of money, regardless of the asset’s current price. This tactic enables investors to increase their asset holdings during market lows and decrease them when prices are high, thereby reducing the overall average cost of their investments.

By automating trades at regular intervals, DCA bots effectively enhance this strategy. One of the best features of these bots is the ability to tailor the parameters of the strategy to suit your unique preferences. This degree of automation not only conserves time and energy but also guarantees a steady execution that remains unaffected by the ever-changing market conditions.

What DCA Trading Bots Are There?

When selecting an automation service provider, it’s essential to consider several key characteristics:

- User-friendly interface: Look for platforms with an intuitive and clear dashboard that allows you to easily create custom bots and navigate features.

- Service reliability: Before committing to a paid plan, test the platform to ensure its reliability and uninterrupted service, regardless of their advertised uptime.

- Cost-effectiveness: Many leading automation vendors offer free access to some of their products or services, providing an opportunity to test their offerings before making a commitment.

- Product diversity: The best DCA bot strategy will require a wide range of features, such as preset solutions, customizable bots, and advanced systems by experts.

- Integration capabilities: A good provider should be compatible with various crypto exchanges, analytical platforms, and third-party tools.

While many crypto companies have these qualities, the best choice ultimately depends on your personal preferences and specific needs.

Luckily, there is an abundance of DCA cryptocurrency bots at your disposal. Some of the top offerings come directly from exchanges such as Binance and Crypto.com. There are also excellent third-party options like Coinrule DCA, Wundertrading DCA, and Shrimpy DCA.

However, Bitsgap DCA is often regarded as the best crypto DCA bot on the market. The Bitsgap crypto trader bot excels in DCA strategies.It offers a long DCA strategy, effectively helping you grow your portfolio while mitigating the effects of market volatility. Additionally, it provides a short DCA strategy, which efficiently handles trading in a downtrend. Furthermore, it features a DCA Futures strategy, designed to enhance your futures trading through robust risk management tools and a myriad of customization options specifically designed for the futures market.

Bottom Line

DCA trading bots are robust automated systems that allocate a predetermined sum of money into a particular cryptocurrency at consistent intervals, independent of its current market price. The main objective of a DCA bot is to mitigate the effects of market fluctuations by dispersing the investment across an extended timeframe, instead of making a one-time, lump-sum investment.

Fortunately, there are plenty of DCA cryptocurrency bots available and the majority are secure and safe to use. As for profitability, it largely hinges on your choice of instrument and configuration settings.

Among its peers, Bitsgap’s DCA bot stands out due to the extensive customization it allows. You can fine-tune it to your liking and use it in conjunction with other automated features like GRID trading. This makes it possible to set up a comprehensive automatic trading system entirely within the Bitsgap platform.

-

Manage Your Business2 days ago

Manage Your Business2 days agoTOP 10 VoIP providers for Small Business in 2024

-

Cyber Risk Management6 days ago

Cyber Risk Management6 days agoHow Much Does a Hosting Server Cost Per User for an App?

-

Outsourcing Development6 days ago

Outsourcing Development6 days agoAll you need to know about Offshore Staff Augmentation

-

Software Development6 days ago

Software Development6 days agoThings to consider before starting a Retail Software Development

-

Edtech2 days ago

How to fix PII_EMAIL_788859F71F6238F53EA2 Error

-

Grow Your Business5 days ago

Grow Your Business5 days agoThe Average Size of Home Office: A Perfect Workspace

-

Solution Review5 days ago

Top 10 Best Fake ID Websites [OnlyFake?]

-

Business Imprint6 days ago

How Gaming Technologies are Transforming the Entertainment Industry