Blockchain

A Comprehensive Guide to Choosing a Binary Options Broker for Mobile Trading

The rise of mobile technology has revolutionized the trading industry, making it more accessible and convenient for traders to engage in financial markets on the go. Binary options trading, in particular, has seen a surge in popularity due to its simplicity and potential for high returns.

Selecting the right binary options broker is crucial for a successful trading experience, and in this article, we will provide you with a detailed guide on choosing a binary options broker for mobile trading. We will focus specifically on the availability, design, functions, and security features of mobile trading apps, so that you can be prepared to try out Quotex for traders in India on your portable device.

Choosing a Binary Options Broker

Before delving into the specifics of mobile trading apps, it is important to consider several factors when selecting a binary options broker. These factors include:

- Regulation and Licensing

Ensure that the broker you pick is regulated by a reputable financial authority. Regulation helps protect your funds and ensures fair trading practices. Look for brokers licensed by recognized regulatory bodies such as the Financial Conduct Authority (FCA) or the Cyprus Securities and Exchange Commission (CySEC).

- Asset Variety

Look for a broker that offers a wide range of assets across various markets, such as stocks, currencies, commodities, and indices. A diverse asset selection allows for greater trading opportunities and the ability to diversify your portfolio.

- Payout Rates

Compare the payout rates offered by different brokers. Higher payout rates can significantly impact your profitability over the long term. However, be cautious of brokers that offer unrealistically high payout rates, as it may indicate a higher level of risk or potential fraudulent practices.

- Trading Tools and Resources

Assess the availability of trading tools, educational resources, and market analysis provided by the broker. These resources can enhance your trading skills and decision-making capabilities. Look for brokers that offer features such as real-time market data, economic calendars, technical analysis tools, and educational materials such as webinars, tutorials, and eBooks.

Mobile App Availability and Features

In today’s fast-paced world, mobile trading apps have become a necessity for traders who wish to stay connected and execute trades anytime, anywhere. When choosing a binary options broker for mobile trading, consider the following aspects:

Cross-Platform Compatibility

Check if the broker’s mobile app is compatible with both iOS and Android devices. This ensures that you can access the app regardless of the mobile operating system you use. Additionally, some brokers may offer apps specifically designed for tablets, providing a more optimized trading experience on larger screens.

User-Friendly Design

A well-designed mobile app is intuitive, easy to navigate, and provides a seamless user experience. Look for a mobile app that offers a clean and clutter-free interface, allowing you to execute trades quickly and efficiently. The app should have a responsive design that adapts to different screen sizes and orientations, ensuring a consistent user experience across devices.

Real-Time Data and Notifications

The mobile app should provide real-time market data, including price quotes, charts, and news updates. Having access to up-to-date information is crucial for making informed trading decisions. Additionally, it should offer customizable push notifications to keep you informed about important market events and price movements, even when you are not actively using the app.

Order Execution

A reliable mobile app should enable swift order execution, ensuring that your trades are performed promptly without delays. It should provide options for placing different types of orders, such as market orders, limit orders, and stop-loss orders. Look for features such as one-click trading, where you can execute trades with a single tap, and the ability to set price alerts to monitor specific market conditions.

Charting and Technical Analysis

Advanced charting tools and technical analysis indicators are essential for making informed trading decisions. The mobile app should offer a variety of chart types, timeframes, and drawing tools to conduct technical analysis conveniently. Look for features such as customizable indicators, trend lines, and Fibonacci retracements. The ability to save and access your preferred chart settings across different devices can further enhance your trading experience.

Account Management

A robust mobile trading app should provide comprehensive account management features. This includes the ability to deposit and withdraw funds securely from within the app, view your trading history, monitor open positions, and access account statements. Look for apps that offer a seamless integration with your broker’s online platform, allowing you to manage your account across different devices.

Social Trading and Copy Trading

Some mobile trading apps offer social trading or copy trading features, which allow you to follow and automatically copy the trades of successful traders. This can be a valuable tool, especially for novice traders who want to learn from experienced professionals or for those who prefer a more hands-off approach to trading.

Security and Safety Features

Security is of paramount importance when it comes to mobile trading apps. Ensure that the broker’s app incorporates the following security features:

- Encryption: The app should utilize robust encryption protocols to safeguard your personal information and financial transactions. Look for apps that use SSL (Secure Socket Layer) or TLS (Transport Layer Security) encryption to protect your data. This ensures that your sensitive information, such as login credentials and financial details, remains encrypted and protected from unauthorized access.

- Two-Factor Authentication (2FA): Two-factor authentication adds an extra layer of security to your mobile app by requiring a second verification method, such as a unique code sent to your mobile device, in addition to your login credentials. This helps prevent unauthorized access even if your login details are compromised.

- Secure Payment Options: Verify that the mobile app supports secure payment methods, such as credit cards, e-wallets, and bank transfers. The app should process transactions securely and protect your financial information. Look for brokers that partner with reputable payment service providers to ensure the highest level of security for your funds.

- Account Protection: A reliable mobile app should offer features like password protection, session timeouts, and account lockouts to prevent unauthorized access to your trading account. These measures help protect your account from unauthorized use, especially if your mobile device is lost or stolen.

- Data Backup and Recovery: Mobile apps that provide automatic data backup and recovery options ensure that your trading history, preferences, and settings are securely stored and can be easily restored in the event of device loss or malfunction. This feature is particularly important to safeguard your trading data and configurations.

- Customer Support: Evaluate the availability and responsiveness of customer support through the mobile app. A reliable broker should offer multiple channels for customer support, such as live chat, email, and telephone, to address any technical or security-related concerns promptly. Efficient customer support is essential for resolving any issues that may arise while using the mobile app.

Conclusion

Selecting a binary options broker for mobile trading requires careful consideration of various factors. The availability, design, functions, and security features of the mobile app play a crucial role in determining the overall trading experience.

For mobile trading, prioritize brokers with cross-platform compatibility, user-friendly design, real-time data and notifications, efficient order execution, advanced charting and technical analysis tools, and secure payment options. Additionally, emphasize security features such as encryption, two-factor authentication, secure payment methods, account protection, and data backup and recovery.

-

Marketing Tips3 days ago

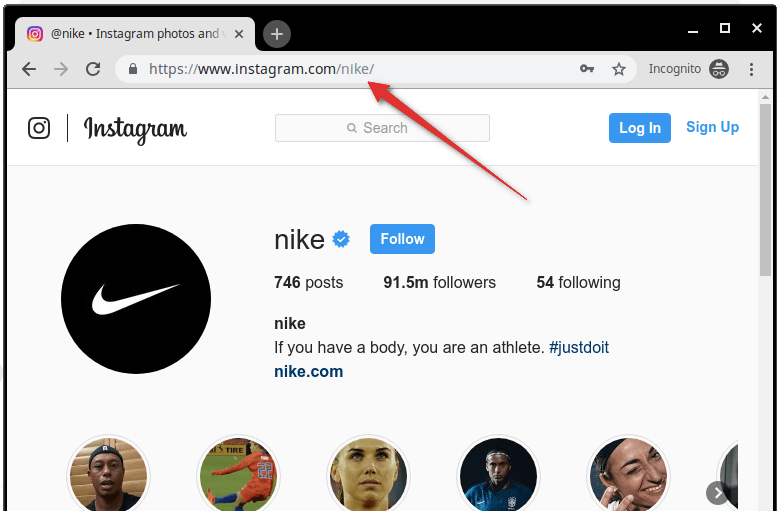

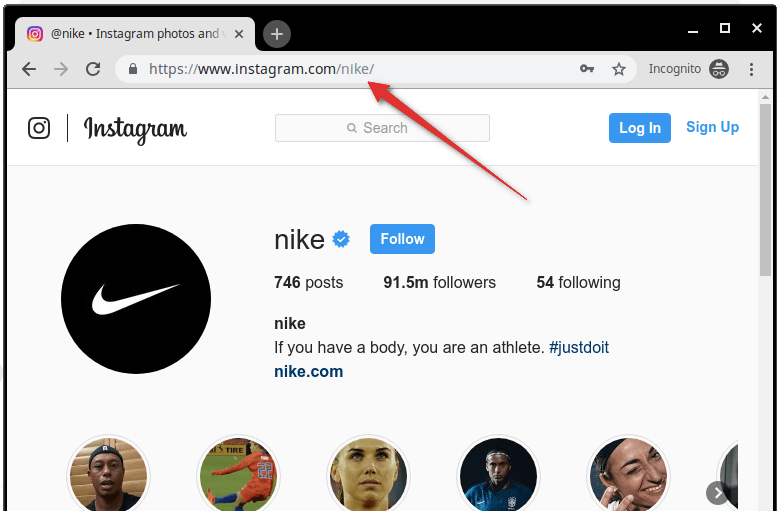

Marketing Tips3 days agoWhat is my Instagram URL? How to Find & Copy Address [Guide on Desktop or Mobile]

-

Business Imprint4 days ago

Business Imprint4 days agoAbout Apple Employee and Friends&Family Discount in 2024

-

App Development4 days ago

App Development4 days agoHow to Unlist your Phone Number from GetContact

-

News5 days ago

News5 days agoOpen-Source GPT-3/4 LLM Alternatives to Try in 2024

-

Crawling and Scraping5 days ago

Crawling and Scraping5 days agoComparison of Open Source Web Crawlers for Data Mining and Web Scraping: Pros&Cons

-

Grow Your Business3 days ago

Grow Your Business3 days agoBest Instagram-like Apps and their Features

-

Grow Your Business5 days ago

Grow Your Business5 days agoHow to Become a Prompt Engineer in 2024

-

Marketing Tips3 days ago

B2B Instagram Statistics in 2024